With enthusiasm, let’s navigate through the intriguing topic related to Standard Deduction Amounts for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

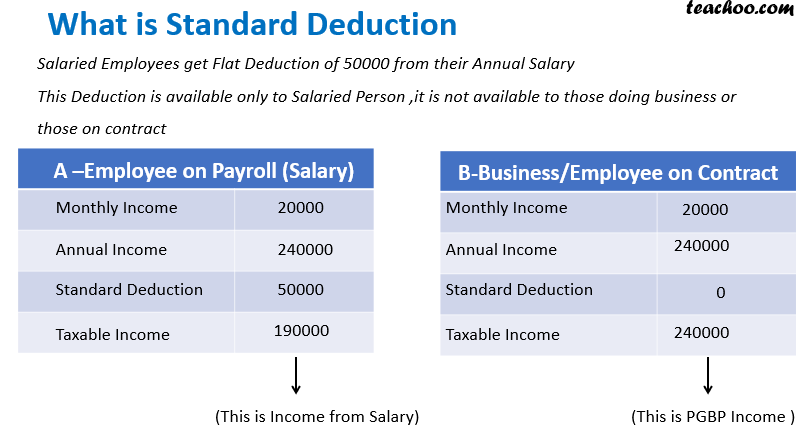

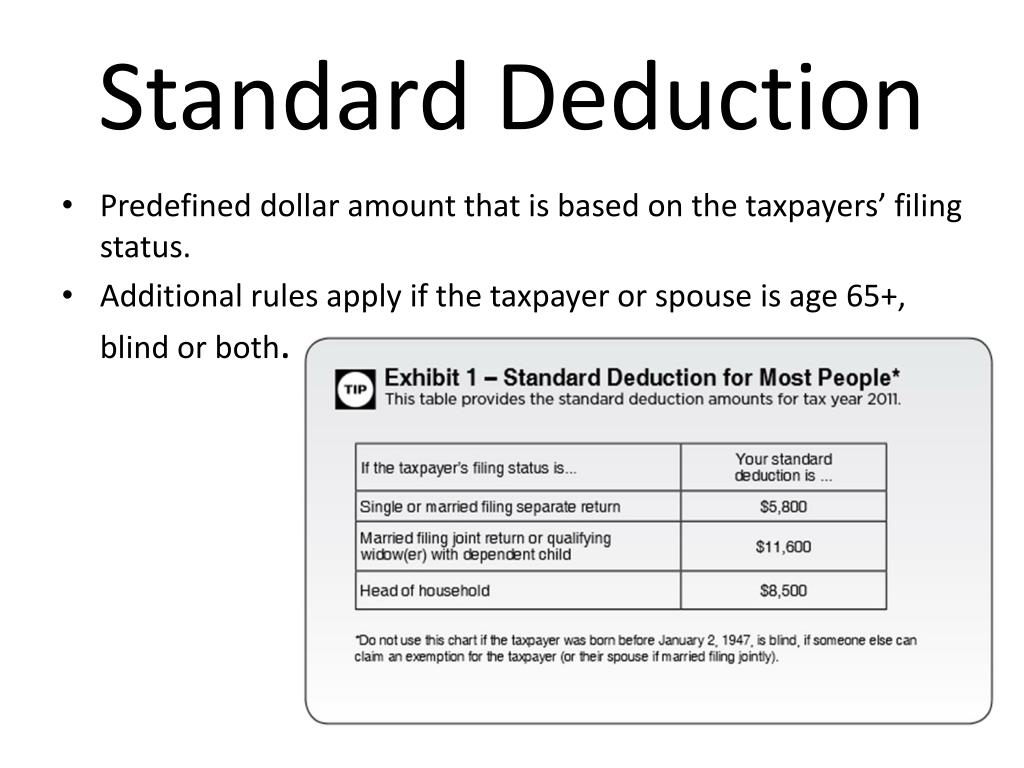

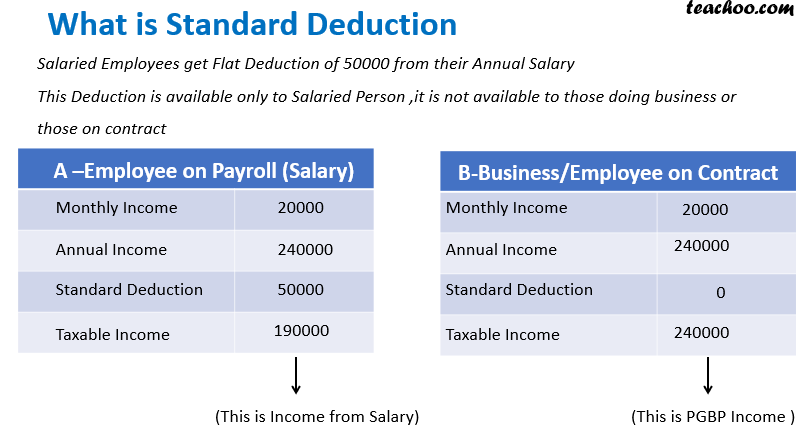

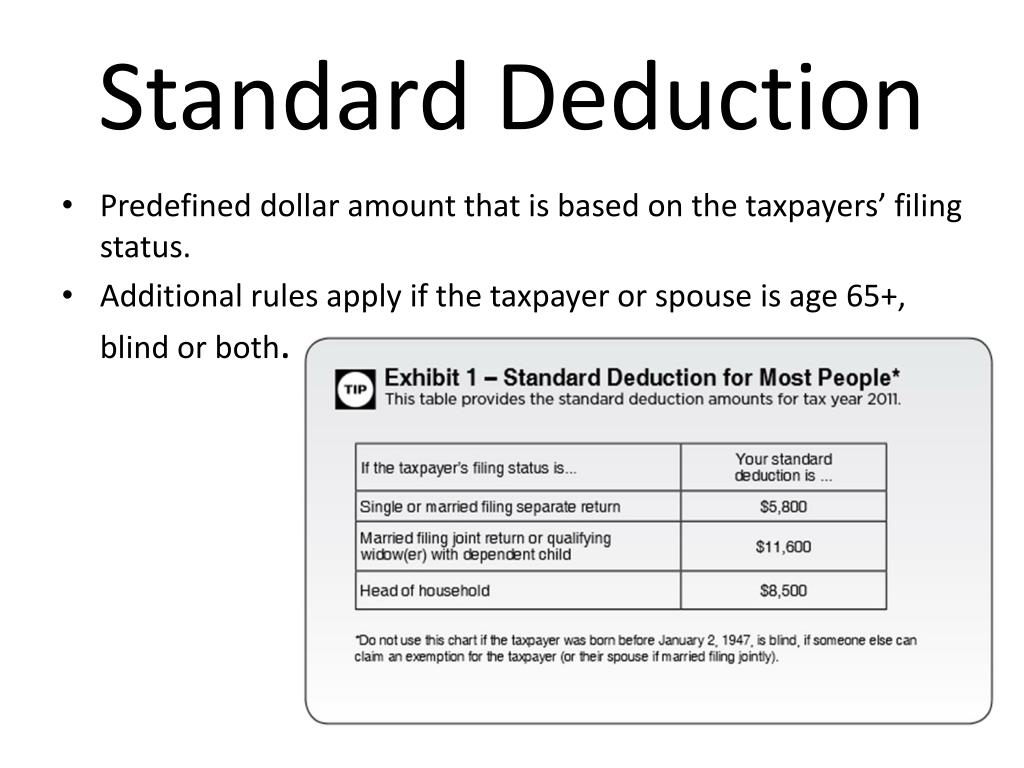

The standard deduction is a specific amount that you can deduct from your taxable income before calculating your taxes. It is a dollar-for-dollar reduction, meaning that it directly reduces the amount of income that is subject to taxation. The standard deduction varies depending on your filing status and is adjusted annually for inflation.

You can choose to itemize your deductions instead of taking the standard deduction. Itemizing deductions allows you to deduct certain expenses from your taxable income, such as medical expenses, charitable contributions, and mortgage interest.

However, itemizing deductions is only beneficial if the total amount of your itemized deductions exceeds the standard deduction for your filing status. If your itemized deductions are less than the standard deduction, it is more advantageous to take the standard deduction.

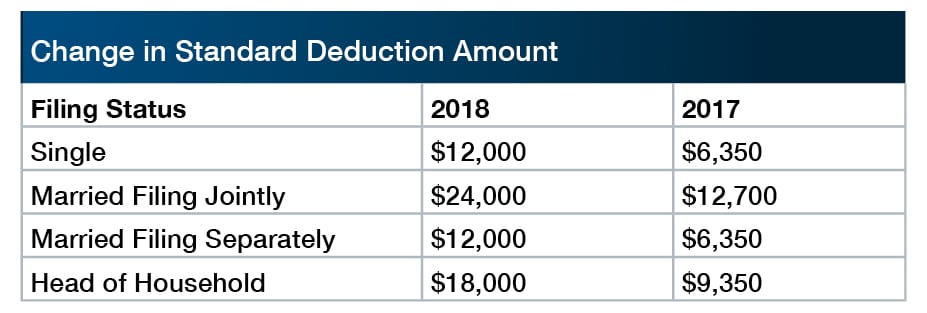

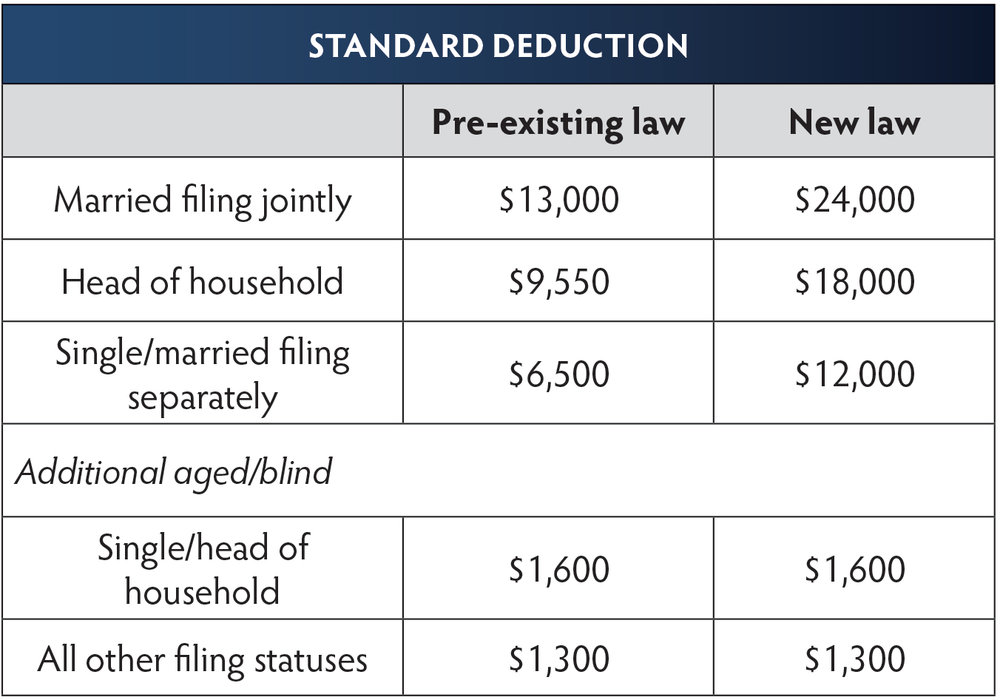

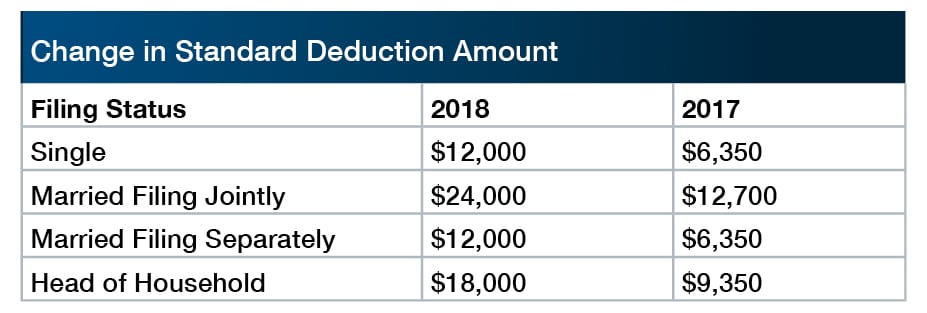

The standard deduction amounts for 2025 have increased from the previous year. The single filing status increased by $900, married filing jointly increased by $1,800, married filing separately increased by $900, and head of household increased by $1,200.

![What Is the Standard Deduction? [2025 + 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

These increases are due to the Tax Cuts and Jobs Act of 2017, which increased the standard deduction amounts and reduced the number of taxpayers who itemize deductions.

The standard deduction is a valuable tax benefit that can significantly reduce your tax liability. By understanding the standard deduction amounts and eligibility requirements, you can make informed decisions about your tax planning and maximize your tax savings.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

![What Is the Standard Deduction? [2025 + 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

Thus, we hope this article has provided valuable insights into Standard Deduction Amounts for 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!